DanubeChance2.0 Embracing failure to facilitate second-chance entrepreneurship in the Danube region

Financial model

In most of Danube region countries, there are no tools for analyzing the financial data, which can be applied to second-chance SMEs.

For this reason, the partners within the DanubeChance2.0 project decided to develop the methodology for a financial model for entrepreneurs’ assessment based on the analysis of selected financial indicators in order to assess the financial situation of the company.

(Click to the picture and you will be redirected to the Financial tool)

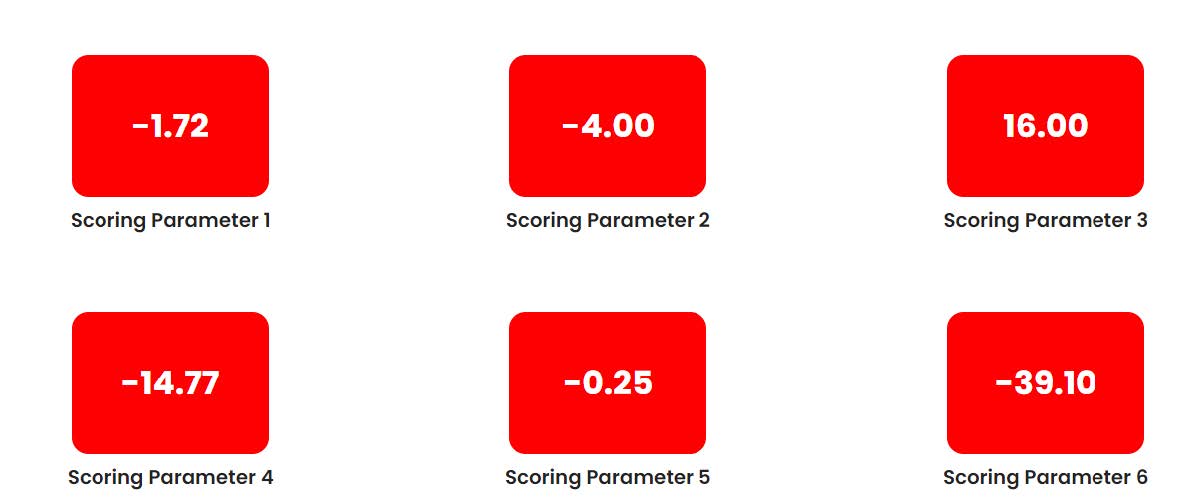

Selected prediction models were created in order to promptly identify the financial distress of companies, by selecting the company in the prosperous or unprosperous group. The result of the model is one value (number), used for the classification of the company into three groups. This value should be a precise reflection of the financial performance and efficiency of the company, the “mirror” to the financial and economic situation of the company.

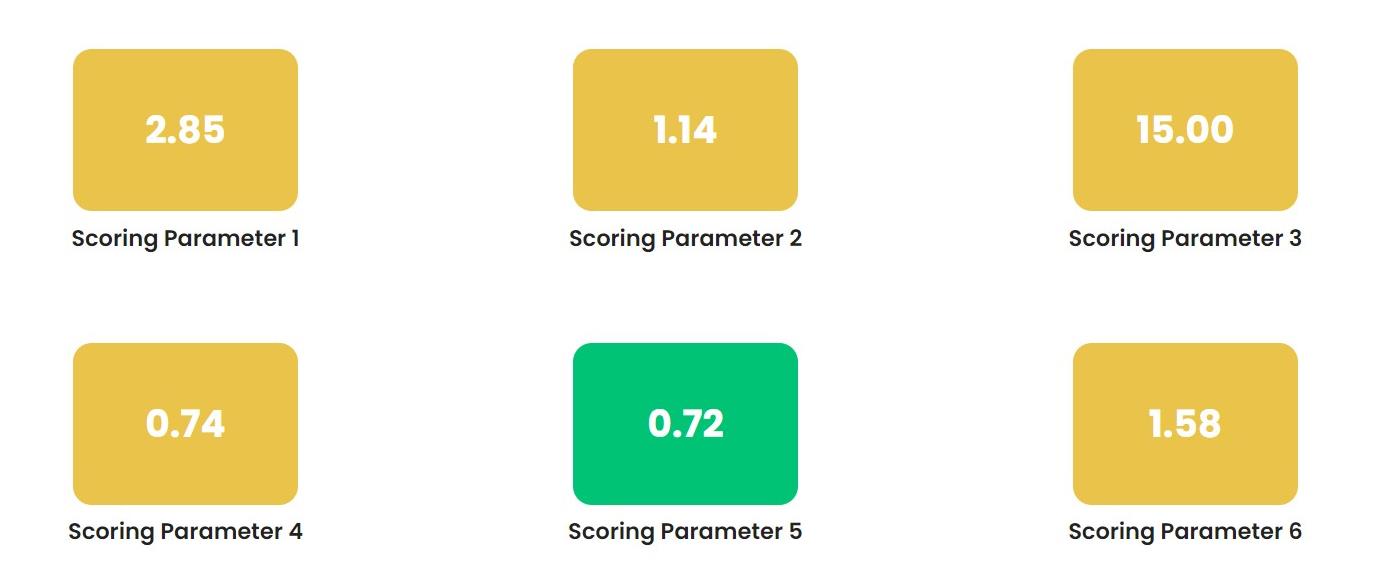

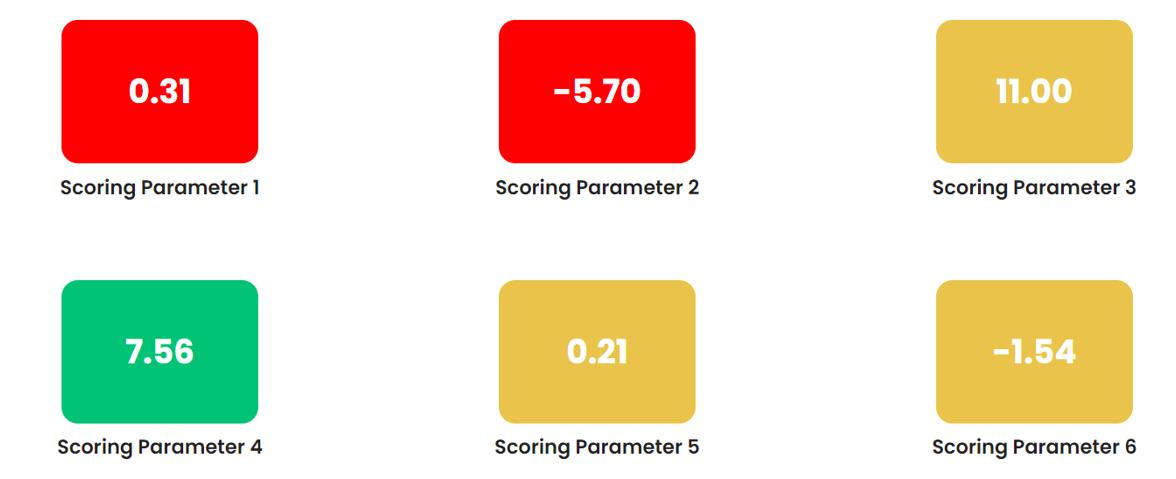

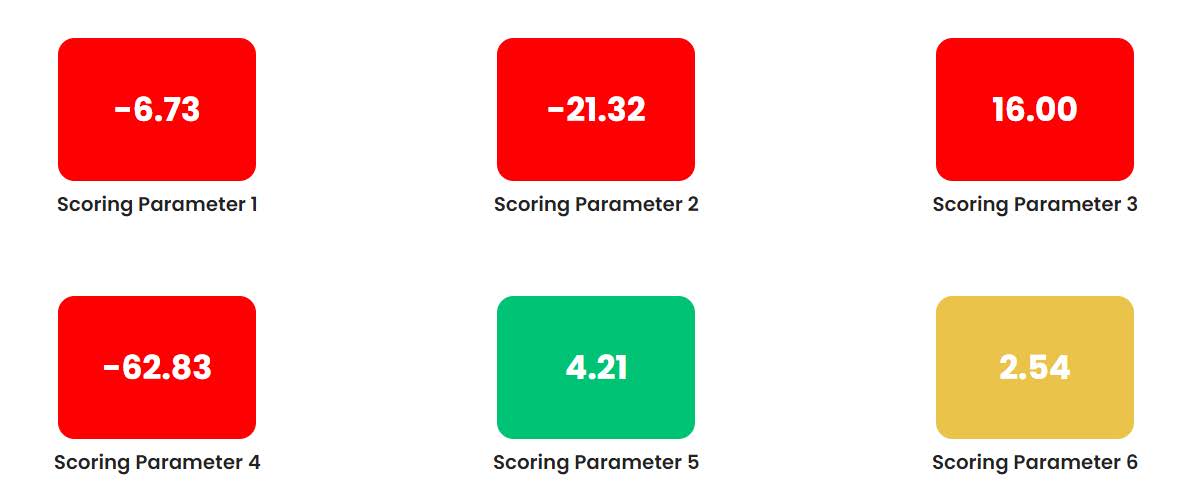

Each of the six models can be indicated with colour, expressing the financial stability of

the company in the near future:

A) Green colour for prosperous companies

B) Orange colour for companies in the grey zone

C) Red colour for companies in distress or unprosperous companies

The final indicator will assess, how many of the integrated prediction models have marked the company with red colour and will classify companies into four groups:

1. Company out of danger (green colour): none of the prediction models marked the company in red colour in the given year.

The company is facing no bankruptcy nor risk of financial distress. Using the methodology of selected prediction models and company’s financial statements, none of the six prediction models detected risk of bankruptcy or financial distress.

2. A company in the financial distress of the I. degree: one or two of the prediction models marked the company in red colour in a given year.

The company is facing the financial distress of the first degree – low risk of bankruptcy. Using the methodology of selected prediction models and company’s financial statements, 1-2 of the six prediction models detected risk of bankruptcy or financial distress.

3. A company in the financial distress of the II. degree: three or four of the prediction models marked the company in red colour in a given year.

The company is facing the financial distress of the second degree – the medium risk of bankruptcy. Using the methodology of selected prediction models and the company’s financial statements, 3-4 of the six prediction models detected risk of bankruptcy or financial distress.

4. A company in the financial distress of the III. degree: five or six of the prediction models marked the company in red colour in the given year.

The company is facing the financial distress of the third degree – high risk of bankruptcy. Using the methodology of selected prediction models and company’s financial statements, 5-6 of the six prediction models detected risk of bankruptcy or financial distress.